The Independent Voice for Conservative Values and the Conscience of the Conservative Movement Less Government is the Best Government |

||||

Liberty Bank Failure-Papé Name Turns to Mud

FDIC and Home Federal to the Rescue

by Scott Rohter, July 2010

"Wisdom is better than silver and gold. All things you could desire cannot be compared to widsom,

but the rich have many friends."

Proverbs 3:13-15, 14:20

Dateline Eugene, Oregon, July 30, 2010

Friday at 5:00 pm on July 30, 2010 Liberty Bank was closed for good by the State of Oregon and the F.D.I.C. The five shareholders of the bank, which are the four principle members of the Papé family and Bob Fenstermacher, (a family friend) just walked away from a $30,000,000 financial obligation that they were required to meet in order to keep the doors to the bank open. Rather than pay the money and meet their financial obligation they chose instead to abandon the bank. The orphaned bank’s deposits and some of it’s liabilities were quickly assumed by Home Federal Bank of Idaho.

Fenstermacher and the Papé family didn’t open up their own wallets to "pony up" one thin dime to re-invest in the failing financial institution, even while they supposedly tried very hard to get others to come up with the required $30,000,000 to keep the bank open. But alas, no one else wanted to invest in their failing bank either. I mean really, would you want to invest in a bank where the owners and principle shareholders weren’t willing to?

So Liberty Bank will close down and re-open under a new name, Home Federal Bank of Idaho, and by arrangement with the F.D.I.C. Home Federal will take over all of Liberty Bank’s deposits and some of Liberty Bank’s bad assets, but what about the rest of Liberty Banks nonperforming loans which are really the Papé family's liabilities and Bob Fenstermacher’s liabilities, the results of all the bad decision making on their part and bad real estate development and construction loans that they made while running Liberty Bank into the ground.

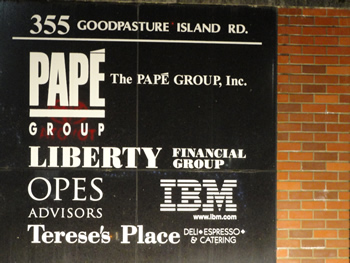

The F.D.I.C. will keep $300,000,000 of Liberty Bank’s bad loans and enter it into a loss-share arrangement with the new owners of the bank on these, but they estimate that it will still cost the F.D.I.C Deposit Insurance Fund (D.I.F.) about $100,000,000. The F.D.I.C. is responsible for that, but only up to a point, because the F.D.I.C. is funded by member banks paying premiums into a pool. However there have been so many bank failures since 2008 when the recession began that even the F.D.I.C. is nearly broke. When the F.D.I.C. runs out of money the rest of the money comes from the U.S. taxpayer! That’s right, the Papé family and Bob Fenstermacher left the U.S. taxpayer probably holding the bag. Think about that the next time you want to patronize one of the many other Papé Group family of businesses like the Papé John Deere dealership or the Papé Hyster dealership or the Papé Kenworth dealership. In fact, the Papé group of companies employs over 2,000 people in 60 locations in 8 states in AK, AZ, CA, ID, MT, NV, OR and WA and has operations in construction, logging, warehousing, material handling, business aviation and trucking. Hopefully they can manage their other businesses better than they can manage other people’s money! And then there is of course the Liberty Financial Group!

The F.D.I.C. will keep $300,000,000 of Liberty Bank’s bad loans and enter it into a loss-share arrangement with the new owners of the bank on these, but they estimate that it will still cost the F.D.I.C Deposit Insurance Fund (D.I.F.) about $100,000,000. The F.D.I.C. is responsible for that, but only up to a point, because the F.D.I.C. is funded by member banks paying premiums into a pool. However there have been so many bank failures since 2008 when the recession began that even the F.D.I.C. is nearly broke. When the F.D.I.C. runs out of money the rest of the money comes from the U.S. taxpayer! That’s right, the Papé family and Bob Fenstermacher left the U.S. taxpayer probably holding the bag. Think about that the next time you want to patronize one of the many other Papé Group family of businesses like the Papé John Deere dealership or the Papé Hyster dealership or the Papé Kenworth dealership. In fact, the Papé group of companies employs over 2,000 people in 60 locations in 8 states in AK, AZ, CA, ID, MT, NV, OR and WA and has operations in construction, logging, warehousing, material handling, business aviation and trucking. Hopefully they can manage their other businesses better than they can manage other people’s money! And then there is of course the Liberty Financial Group!

Do you think that if you owed the Papé family any money that they would just let you walk away from your obligation to them? I sincerely doubt it! Neither should we let them walk away from their obligations to us. Do you think that even one member of the Papé family or Bob Fenstermacher will suffer so much as a harmless little downgrading of their personal credit rating as a result of their bank’s failure? I doubt it. And to think that we just renamed the Beltline after the Papé family, albeit amid much controversy. It probably would have been smarter to wait and see if the bank remained solvent before we did that, but then nobody asked me! Did you know that the Papé family name is a registered trademark? Well I guess that the members of their family won’t have to worry much about anyone infringing on their copyright, or rushing to use the Papé name or logo anymore. As far I’m concerned their name is mud! It's just as muddy as credit default swaps, collateralized debt obligations, quantitative easing, the Troubled Assets Relief Program (TARP), corporate bailouts, slimulous money, Henry Paulson, Timothy Geithner, Fannie May, Freddie Mac, and the entire Federal Reserve Board!

Do you think that if you owed the Papé family any money that they would just let you walk away from your obligation to them? I sincerely doubt it! Neither should we let them walk away from their obligations to us. Do you think that even one member of the Papé family or Bob Fenstermacher will suffer so much as a harmless little downgrading of their personal credit rating as a result of their bank’s failure? I doubt it. And to think that we just renamed the Beltline after the Papé family, albeit amid much controversy. It probably would have been smarter to wait and see if the bank remained solvent before we did that, but then nobody asked me! Did you know that the Papé family name is a registered trademark? Well I guess that the members of their family won’t have to worry much about anyone infringing on their copyright, or rushing to use the Papé name or logo anymore. As far I’m concerned their name is mud! It's just as muddy as credit default swaps, collateralized debt obligations, quantitative easing, the Troubled Assets Relief Program (TARP), corporate bailouts, slimulous money, Henry Paulson, Timothy Geithner, Fannie May, Freddie Mac, and the entire Federal Reserve Board!Other Photos

"The truth, the political truth, and nothing but the political truth. A journalist has no better friend than the truth." - Scott Rohter |

|

© Scott Rohter, Less Gov is the Best Gov .com. All rights reserved.